ENOSYS WHITELISTING PORTAL_

Enosys Whitelist Enable Holders To Become A Verified Holder And Enjoy Timeless And Uninterrupted services

Available on

A user-governed Decentralized Exchange

Ēnosys DEX is the ecosystem's swaps protocol, utilizing smart contracts to provide automated market makers (AMMs) with liquidity.

Participants of the ecosystem can become Decentralized On-Demand Liquidity Providers (DODLP) and earn fees for doing so, while still earning their L1 rewards.

The introduction of new Trading Pairs within the DEX will be decided via Governance proposal, ensuring community interests and reducing the potential for spam or dubious listings within the trading platform.

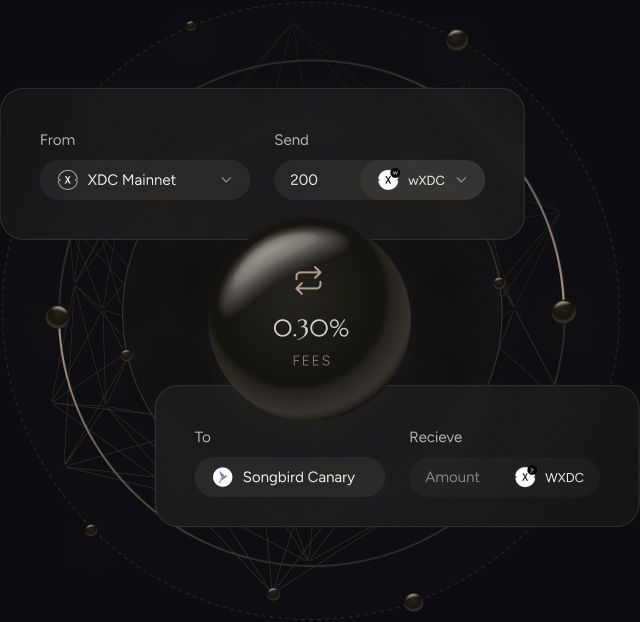

Swap Assets

Ēnosys DEX utilises an Automated Market Making (AMM) model. For each token pair listed on the DEX, there is a corresponding liquidity pool - a smart contract storing the assets provided by other users. The traders then trade against the liquidity stored in that contract.

Provide Liquidity

Ēnosys DEX liquidity pools require a 50/50 token split meaning the user must provide equal value amounts of both tokens. After providing liquidity, the system mints LP Tokens for the user, which act as keys to unlock the provided liquidity. Fees are accrued in real time relative to the users pool share as trades occur.

Earn Rewards

Liquidity Providers are key to the success of any AMM and therefore, must be adequately incentivised. Ēnosys DEX LPs offer a multifaceted revenue stream in the form of Liquidity Fees, L1 Delegation/DIP Rewards, and optional Ēnosys Farms Rewards.

Swap assets while retaining custody

Traders can select which tokens they would like to trade, view real-time charts detailing price history, volume, available liquidity, and how much their trade will impact the market they are trading in. Additionally, traders can see the fees taken from their trade if conducted. All without having to custody your assets with a centralized exchange.

Fees

Fees from each trade are taken in the form of the currency being traded, or in Enosys’ secondary governance tokens. Fees are set at 0.30% of each trade conducted. This fee is adjustable via a Governance proposal.

90%

Liquidity Providers

2%

APY Cloud

8%

Ēnosys Team

Liquidity Pools

Anybody can become a liquidity provider on Ēnosys DEX if they own both tokens of a listed trading pair. By providing their tokens (an equal value of both) to the liquidity pool, they earn a proportional share of swap fees. This liquidity is represented by LP tokens which can then be staked in Ēnosys Farms to earn additional incentives.

Both the DEX and Farms feature a Simple Staking tool which allows a user to automate the process of going from any single asset into any Farm pool, all with one button.

Ēnosys Farms

Ēnosys Farms is the ecosystem's non-custodial yield farming platform. Users can stake cryptocurrencies and earn yield paid in other cryptocurrencies as a reward. Single token, LP dual token and time-locked pools are available, all with integrated support for L1 rewards while staked.